Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase .

Taxes.

The very word seems to strike fear into the hearts of the bravest. According to a recent report shown on Global news. Ca Canadians pay, on average, 42.5% of their income in taxes each year!

It’s the start of Tax Season and I’m here today to belay your fears and bring you the 411 on Taxes, including personal taxes and small business taxes, filing deadlines, software options and Online Efile options.

Obviously, this is a HUGE area and one post isn’t going to cover everything in depth but, I will endeavor to impart my significant wealth of knowledge to you here today. By the end of this tax season I will have been instrumental in over 1000 T1 filings, working 7 days a week! It’s no wonder we end the season on June 21st with a staff party.

For the main, I will focus on Canadian taxes but later I shall weigh in a little on US taxes.

(Please see my disclaimer page for information about my affiliate links, which may or may not be included within this post)

Where to start?

Many people are confused by taxes so let’s start with the basics.

If you are employed you will receive a T4 from your employer BEFORE February 28th. This is the latest date an employer is allowed to get to, without having issued this document.

If you are unemployed you will receive a T4E from the government.

If you are self employed or have a side business (Etsy shop, Blog with affiliate income, drop ship enterprise,… whatever) you will prepare an Income and Expenditure statement [IE] (or a Profit and Loss account [P&L]) to account for your NET income (after allowable expenditure) to the CRA. This also works for the IRS but the forms will have different names.

You may be like me and have a combination of the above. I have a part time job as a bookkeeper in a professional chartered accountant’s practice, I work part time as a Self employed Financial controller / Bookkeeper and I have my Blog 🙂

This year, I will receive two T4’s from my employers (1 past / 1 present) and I will prepare two IE statements (P&L’s) for my two sources of additional income.

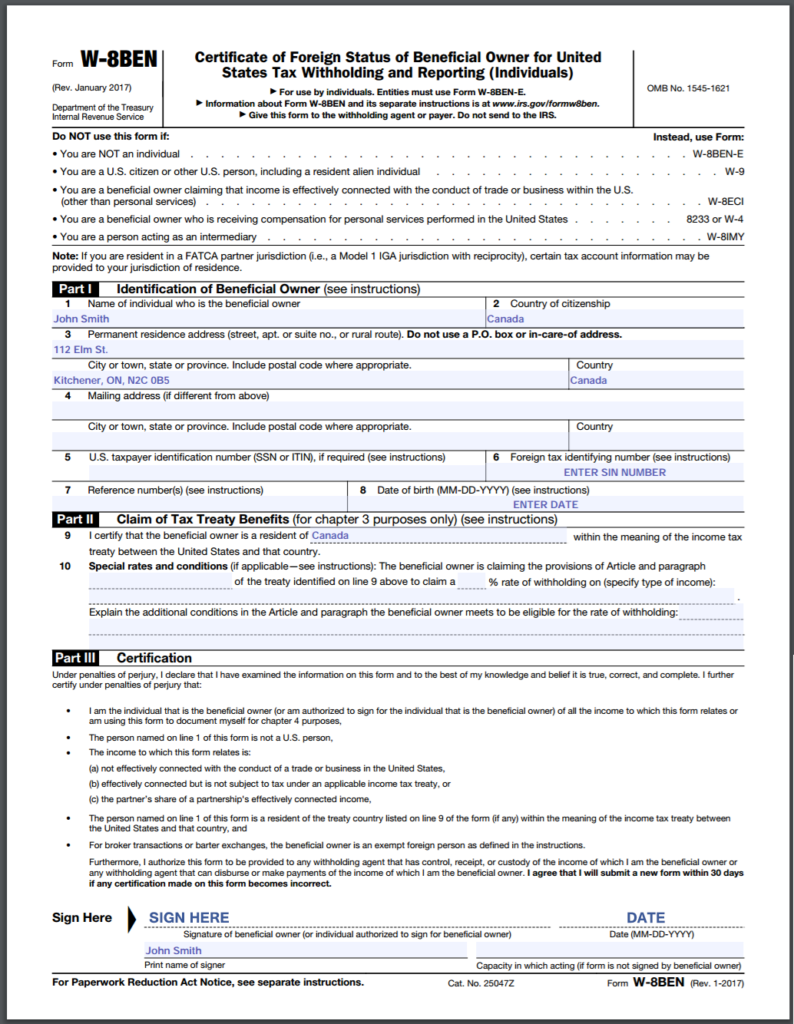

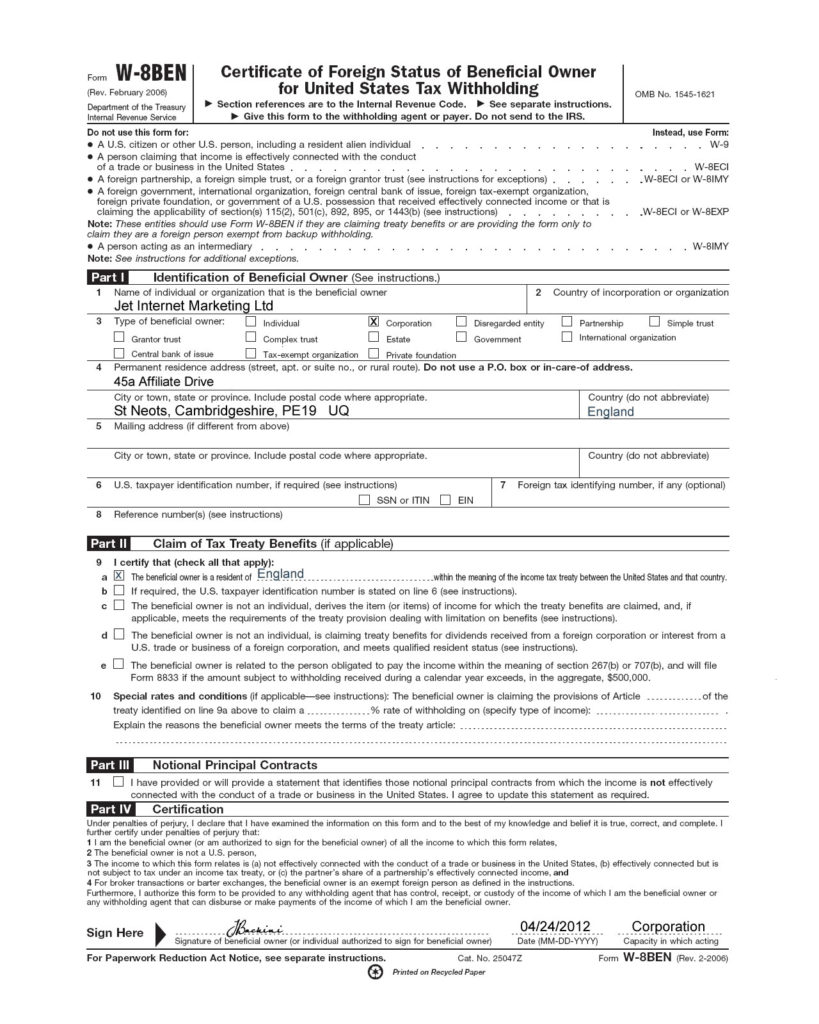

Affiliate income: if you have an affiliate account with a US distributor you will have been asked to complete a W8 which allows you to file and pay taxes on your income from these sources in Canada. (It’s a W-9 for US citizens).

EDIT: January 28th 2019

It was brought to light that I may need to go into a little more detail on the W8, especially for those of us who have an association with Amazon, so here goes…

The idea behind the W8 is to determine whether any withholding taxes should be deducted on payments to you or if the payment can be made in full. There exists a Tax Treaty between the US and Canada which has the main goal of preventing double taxation for Canadian Tax payers. The IRS does report income to the CRA (so don’t think they won’t know!!)

Completing a W8 is not too complex but I have a couple of visuals here to assist:

-

Canadian Individual

2. Business or corporation

Once you have completed the correct form it is filed with the affiliate program provider (in our case Amazon) and your payments from there on in are not taxed (at 30%!!) in the US.

Differentiating between a Hobby and a Business.

It appears that the IRS has stricter rules than the CRA but as a general guide there are a few tests that can be applied to decide whether you should be declaring your “Passion for knitting socks” as a business after selling 6 pairs at the local craft market or if you can remain quiet about it.

The Canada Revenue Agency (CRA) applies certain criteria to interests that resemble hobbies, yet technically qualify as businesses. The amount of income received versus expenses incurred determines whether the CRA sees your part-time activity as a hobby or business.

The Profit Test

The CRA uses the profit test to gauge whether the income received from a hobby should be treated as business income. For example, if you’re knitting sweaters for fun and the amount of money you receive is much less than the materials you purchase to make them, the hobby designation still stands. However, if your expectation is to turn a profit, then any income received from the pursuit must be reported on Form T2125 or the Statement of Business or Professional Activities. This form is part of the T1 income tax return bundle. The income from a perceived hobby is considered taxable, especially if a history of profit can be shown through the years.

Gathering and Organizing your financial records.

Once you have any Income records from your employer(s) it is time to gather all other expense receipts and organize them by category.

I use a very simple system of hanging folders with labels for each category but there is a veritable plethora of options out there, from simple to suave; plain to professional or brightly colored. There is something for everyone’s tastes so, chose one and let’s move on.

The main categories for Income taxes (and Small business taxes) look like this:

- Income from all sources – separated between sources

- Office supplies – (e.g. planners, lovely pens, notebooks, printer ink)

- Equipment purchases – (e.g. lap top, printer)

- Advertising / Marketing or Promotion – (e.g. Facebook boosts, google ads, etc)

- Vehicle costs and travel expenses

- Payroll or subcontract payments

- Continued Development (e.g. courses, books, webinars, attendance at conferences)

- Niche specific – (e.g. Decorating magazines for Home improvement blogs, or Cricut magazines for Craft blogs, supplies for resale on Etsy etc.)

- Software costs – (e.g. Turbotax, Quickbooks, Mailerlite, Canva, Tailwind, etc)

- Medical expenses

- Charitable donations

- Student loan interest

This is not a definitive list!

Once you have all of this information you will want to go through your bank statements and Credit card statements for anything you may have missed. If you use a credit card solely for business purposes and do not pay the balance in full then the interest charged is an allowable expense on your I&E statement. Same goes for bank charges and interest on your business account.

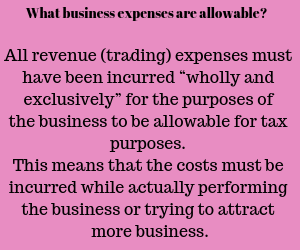

How do you know if an expense would be allowable?

The main wording to focus on here is “Wholly and exclusively” so, for my darling realtor friends, whilst having nice hair and pretty nails is expected, getting your hair did and nails replaced weekly is NOT a necessary business expense (lol). Your business would function just as well with plain, clean, short nails.

Review your expenses and look for credits and deductions.

Once everything is organized it is easy to review the information to identify credits and deductions that you may have been missing. Accounting software can help you maintain your books and records and keep you prepared for filing taxes (including other taxes like GST and PST and don’t forget source deductions for employees and Worksafe BC contributions!!). I would always recommend consulting a tax professional for insight into what you may be eligible for but the option is yours.

Spreadsheets can help you stay organised in a very cheap and simple way. These can be used in conjunction with a Tax-prep software (like Turbotax by Intuit). Please be sure to download the latest version of your tax-prep software as this changes each year and has the latest allowance and deductions, tables and resources in each version.

Medical expense receipts (NOT MSP premiums) are a tax deductible expense with a clause:

If you incurred medical expenses above a certain threshold of net income, you can claim additional medical expenses. There is also a maximum amount you can claim each year, and it can vary from year to year. Amounts greater than this threshold give rise to a 15 percent federal tax credit.

This means there is a minimum level of medical receipts needed to be able to claim them. The amount needed is a percentage of your income. If your medical expenses in one year fall below this threshold you can save them and roll them into the next year. So, in the year that we paid over $10,000 out of pocket for my daughters surgery my threshold was x% of my income at that time. As my expenditure exceeded the minimum level needed, but did not breach the maximum level allowed, I was able to claim all of my expenditure for that year.

Side note:- it was later disallowed and then reinstated once the CRA assessment team where satisfied with the additional documentation supplied by us and her surgeon.

Student loan interest:- can be claimed as a tax credit.

Expenses incurred when Employed:- these can be things like professional subscriptions for people who work in finance or uniforms for wait staff if there is a specific dress requirement not provided by your employer. Protective clothing for loggers, miners, etc supplied by you for the purpose of performing your work. Usually, to be allowable, these expenses have to be a part of your employment contract (like using your own car to drive to clients when you do not receive an expense allowance or reimbursement) and your employer does have to sign the CRA form to allow you to claim these items.

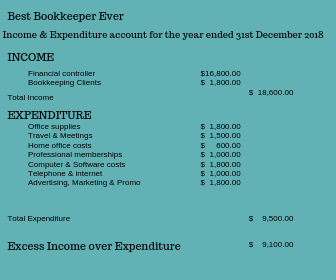

How to prepare and Income & Expenditure Account.

If you aren’t using any accounting software then a simple, manually prepared IE looks like this:

Rinse and repeat for each stream of distinct and separate income that you have.

Keeping your financial records in order is hugely important to the success of your business. Not only does it keep you up to date with your profits and losses, but legally speaking, it is necessary to have your records straight and to have a receipt or invoice for each purchase being claimed. In Canada we must keep 6 + current year (so 7 years) of financial information in the event of an audit. Also, for you as a business owner (yes blogger friends – that’s your little business you got going on there) it makes good business sense for you to understand what exactly is happening with your money.

Completing and Filing your Tax return.

File your income taxes for free with TurboTax! Ideal for simple returns, File today! (Valid until 4/30/18)

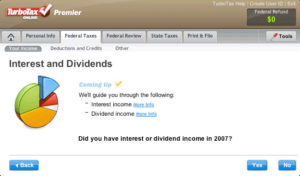

I always use a Tax prep and online filing software in one. Usually it is Turbotax by Intuit which has CRA netfile included but I have used HR Block online software too in the past. This year I get to take advantage of professional accountant tax prep software at my office. That being said, online tax software is designed to walk you step by step through the preparation and filing of taxes through a series of questions. It couldn’t be simpler.

(Turbotax does have a US version which offers Free filing for Simple returns. Here’s the link… TURBOTAXFREE)

Each screen will look something like this:

Tell us about yourself:

- Do you have Income from employment [ Yes] [No]

- Do you have Income from Self Employment [Yes] [No]

- Do you have income from Interest or Dividends [Yes] [No]

- Did you buy a house [Yes] [No]

- Did you have a baby [Yes] [No]

For each question there will be a question mark in a circle to the right of the question, which will explain what they are asking you in more detail should the question be confusing to you.

For each section that you answer [YES], the software will download the necessary forms and guides that match your answers. Remember – nothing is set in stone. If you get to the end and find you missed something out there are opportunities to alter, return to or add in / remove elements, as required.

At anytime you can save where you are up to and return to it later. The CRA DOES NOT SEE this information until it is FILED.

For anyone NOT wanting to pay a professional, this is your best option AND it’s not expensive. Depending upon your level of income, some returns are free. Normally my joint return with Mr. Spend Anon is around $50.

At the end of the information gathering a filling in of the software we are left with useful tips and information on how to reduce our Tax exposure, such as making additional RRSP contributions.

Registering for a CRA Account.

Now is a great time to gain full access to your CRA information, from filed T4’s to previous assessments and filings. It takes some time to go through the verification process but you can start here.

With access to “MY ACCOUNT” you no longer need to wait for T4’s to be mailed to you. Once the employer has uploaded their filings to CRA, your T4 is viewable in your account.

Within the portal you can also set up automatic deposits for faster refunds (should you be so lucky).

What if you had no income in the previous year? You should still file a Nil return. By filing your taxes you gain access to benefits and credits to help you get by such as the quarterly GST reimbursement for low income families and Working Tax credit for people with kids, etc.

Tax Filing Deadlines.

Don’t procrastinate. Waiting until the last minute to file your taxes doesn’t leave you breathing space to find missing receipts or to adequately organize so that you don’t miss any benefits or credits.

Filing your taxes on time also means that you won’t incur interest or penalties on amounts owing (as long as you pay them on time too).

Important CRA due dates for individuals and small businesses.

- Individuals (and most business owners) must file their taxes by April 30th of the year following the tax year for which the return is being filed.

- Self-Employed people have a small extension to June 15th for filing although the CRA will begin assessing interest on your tax due on April 30th.

The CRA NETFILE service opens in early February each year for those Eager Beavers.

If you make installments on your taxes these payments are due quarterly on March 15th, June 15th, September 15th and December 15th.

- Business deadlines of April 30th are for companies whose Fiscal year end matches the calendar year end (Jan 1st through to Dec 31st). If however, your fiscal year end falls differently (Say May 31st) your returns are due 6 months after this year end date.

GST / HST

If you reach the income threshold ($30,000 over 13 months or 4 consecutive quarters) then you are required to account for and file GST / HST returns. In all cases the return and the payment of applicable tax is due one month after the end of the reporting period.

Born in the USA?

I will say right now – I’m not an expert in taxes in the US but here’s what I do know…

Not everyone needs to file a Federal Income Tax return (although in all likelihood, if you worked at all in the past year, you probably will). The only time you wouldn’t need to file is if your income was less than the standard deduction amount which for 2018 was $12,000 for individuals, $24,000 for married couples and $18,000 if you are filing as the head of a household.

Even if you didn’t meet these thresholds it may still make sense to file a return such as, if you paid any State or Federal withholding taxes. You can’t get tax refunds if the IRS don’t receive a return! The same goes for Tax Credits such as the EITC (Earned Income Tax Credit) which can get you a significant amount back if you are a low income earner.

Whereas in Canada employees receive a T4 in the US employees receive a W-2. This should be in your hands no later than Jan 31st. In addition you may receive 1099-INTs that reports interest earned on your bank accounts and 1099-DIVs that reports any dividend income from your investments.

Other forms may include:-

- 1098 – Mortgage interest

- 1095 A,B and C – Health Insurance coverage

- Charitable donations

The tax filing deadline is April 15th but, just like in Canada, it is adjusted to account for weekends or holidays so, for instance, April 17th 2019 is your official filing deadline date.

Missing the deadline for filing or not paying on time seems to be a lot harsher in the US with individuals being subject to a failure-to-file penalty, which is typically 5% of your unpaid taxes accruing for each month that you are late PLUS a maximum additional penalty of up to 25% of your unpaid taxes. This is further compounded by additional non payment penalties of 0.5% – 1% of your unpaid taxes for each month that they remain unpaid.

If you find that for some reason you will be unable to file and pay by the deadline, you are allowed to request an automatic six-month extension that gives you to Oct 15th to file. this will help you avoid the failure-to-file penalty (as long as you don’t miss the Oct deadline). This only applies to the filing of your return. Payments are due by April 15th and interest starts accruing on unpaid taxes from that date.

Update Feb 2019: My American neighbours are losing some tax breaks this year. Head over to CNBC.com to take a look at What you won’t be able to claim this year.

How to file your taxes.

Option #1: IRS free e-file

If you make less than $60,000 you are eligible to use the IRS’ free tax-filing software which guides you through the process of filling out your return.

Option #2: Tax Prep software

If you earn more than $60,000 but your financial affairs aren’t really complicated enough to warrant hiring a Tax accountant then tax preparation software is the way to go. Again, this is where I would recommend something like Turbotax by Intuit (US version, obviously).

The have a free version for simple returns and guarantee the greatest refunds. This is who I use.

Option #3: Hire a professional

In most cases expert help pays for itself in missed credits and deductions and tax minimization advice as well as financial planning for next year and into the future. With the new 2018 tax reforms in effect most people are wondering how these reforms will affect them. This is where a professional is invaluable.

Just as we Canadians do, our neighbors can expect rapid refunds (usually within 21 days) but as early as one week later and you can check the status of your refunds within 24 hours of filing.

What if you can’t afford to pay?

I get it. I really do. If you are in this situation where you will owe taxes and do not have the money to pay FILE your Return Anyway and then contact the CRA / IRS to discuss options with a representative. Here in Canada you can request a payment plan and in the US you can file an online payment agreement that allows you to defer payment for 120 days or you can request a payment plan.

Additional reading:

Don’t forget to keep on Educating yourself:- 100 top reads for further self learning.

XO

Anna

Thanks for this info! Very helpful!