Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase .

The Ultimate Guide to Taxes for Bloggers.

Almost all of the blog posts about Taxes for Bloggers start with the disclaimer “I am not an Accountant…..”.

Most of you already know that I have worked in Accountancy practice since I was 18 years old and went to school on the weekends to earn my designations. Today (32 years later), I work part time in a local CPA firm and this tax season we will file in excess of 1000 Tax returns. That being said – EVERYONE’s tax situation is different.

If you are in anyway unsure about your filings, seek out a recommended professional and have them take a look for advice that is tailor made for your unique situation.

Do I need to register my blog as a business?

The first question most people ask is “Do I need to register my blog as a business” and the answer to that is No. You do not need to “register”. There is no mandatory declaration form to announce to the CRA/IRS that you have started a blogging business. Do not confuse this with Do Bloggers Pay Taxes. The answer to that question is a resounding YES.

There are only two things for certain in this life:- Death and Taxes!

Hobby .v. Business – there is a significant difference.

When dealing with the CRA there are two options for declaring Blogging income – one line on the T1 Tax return that asks – Did you make any money for a web page or website, (here you may list your top five revenue producing sites) and the other is actually preparing Accounts for your new enterprise on a T2125 – Statement of Business or Professional Activities.

The CRA rules for your business being classed as a hobby are similar but the IRS has a much harsher view of earning income online. It is generally accepted that it may take a few years for a new enterprise to make a profit however, if your business reaches year four or five of continuous losses, the IRS can declare your business and hobby and all expenses are now disallowed.

How do you distinguish between a business and a hobby?

- Whether you carry on the activity in a businesslike manner and maintain complete and accurate books and records.

- Whether the time and effort you put into the activity indicate you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether your losses are due to circumstances beyond your control (or are normal in the startup phase of your type of business).

- Whether you change your methods of operation in an attempt to improve profitability.

- Whether you or your advisers have the knowledge needed to carry on the activity as a successful business.

- Whether you were successful in making a profit in similar activities in the past.

- Whether the activity makes a profit in some years and how much profit it makes.

- Whether you can expect to make a future profit from the appreciation of the assets used in the activity.

You may find more information on this topic in section 1.183-2 (b) of the Federal Tax Regulations.

The CRA considers blogging, which results in payment (or income), as a business activity. Money earned from blogging is therefore treated as self-employment income with you as a Sole-proprietor.

Since blogging is a business it will incur regular operating expenses which can be claimed to reduce the Income made, IF they qualify as allowable deductions. The CRA also acknowledges that the initial years of a blogging business, like any other, may not result in a net profit which allows a blogger to claim these losses on their tax returns. Operating losses from this year can be carried forward to reduce profits made next year.

You should also be aware that claiming losses on your tax return every year could result in an Audit. The CRA’s expectation for claiming these losses is that you have a reasonable expectation that your business will succeed and eventually make a profit.

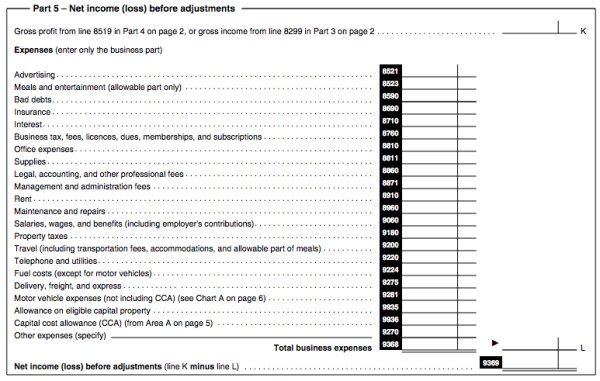

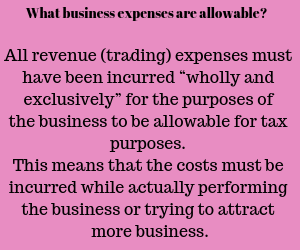

What constitutes a Tax Deductible Allowance?

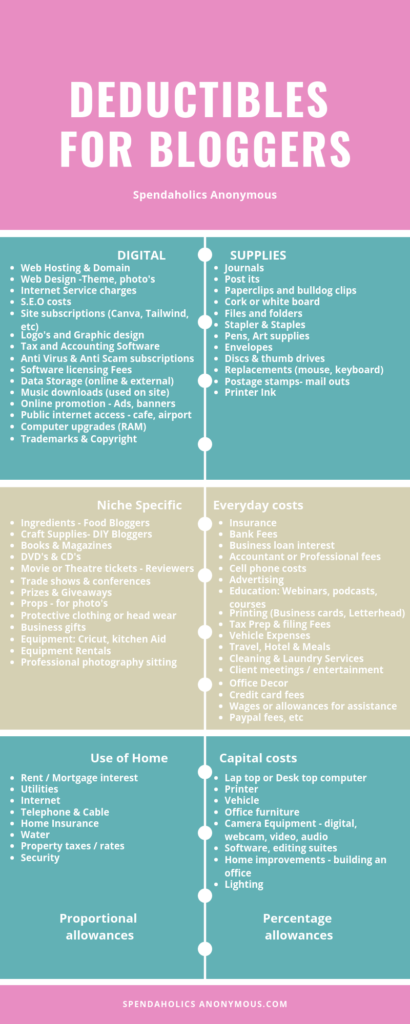

The expenses that bloggers can claim or “write-off” for taxes is the same as any small business.

Do not assume you can write off anything and everything against your income because that is not the case. All taxation agencies, be they the Canada Revenue Agency (CRA), Internal Revenue Service (IRS) or The Inland Revenue, have specific guidelines as to what you can and can’t claim to lower your taxable profits.

I do not want to take up this page with a bullet point list so here is an infographic that may be downloaded for easy reference.

This is by no means a definitive list of allowable expenditure. For example, if you have a Guard Dog (and can prove the dog is needed for security of your business), ALL THE THINGS Doggo related may be allowable.

Post office boxes, Security deposit boxes, headache pills, physio for your Carpal tunnel – all may be allowable if they were incurred solely in the pursuit of your business income.

Meals out with other bloggers are allowable up to 50%. Be sure to talk about your blogs! Buying lunch with a client – only the clients portion of the bill is allowed.

Using a space in your home as your office. (*update for US)

Use of home as office, for those of us who do not have a designated room to use as such, needs to be specifically calculated to exclude any and all personal usage.

- Calculate the square footage of your home.

- Calculate the square footage of the Space you use as your office.

- Divide one by the other to obtain your office use percentage.

For example:- my home is 1450 sq ft and I take up around 420 sq ft while I am working (mostly counter space at the Kitchen Island).

420 / 1450 = 29%.

4. How many hours do you spend in that space at your work?

For example: I spend 10 hours out of 24 every Saturday and Sunday and I average 1 -2 hours per day through the week.

30 hours work / 168 hours in a week = 17.85% (18%)

I therefore claim 18% x 29% of my household bills like electricity, internet, heating, etc as my allowable, deductible expenditure.

BC Hydro Electricity $150 / month.

$150 x 29% = $43.50

$43.50 x 18% = $7.83.

I would recommend a simple spreadsheet to help with the calculations. Here’s one I have prepared for you to use.

Not all of your vehicle expenses are allowable. these are again, subject to personal use rules. My best advise here is to maintain a thorough mileage log detailing business mileage and personal mileage. All other vehicle expenses can be apportions using this ratio annually.

For example:- Total mileage 30,000. Business specific mileage 5000.

Allowable costs 5000/30000 x 100 = 16.667% (16.5%)

(*update) 2018 sees the removal of this itemized allowance for telecommuters in the US (People who work from home).

Head over to read the Feb 2019 update from Cnbc. com and check out the OTHER tax breaks you will be losing this year. Sorry Neighbours!

(**another update) The new tax system in the US is causing some severe consternation and people are asking “Will I benefit under the new tax rules?” Should you itemize expenses or opt for the blanket deduction. This is where I would definitely recommend visiting a Tax professional in your State.

Calculating Capital Cost Allowances

The CRA (and I suspect the IRS) have specific cost classifications for expenses they consider to be Capital purchases or Assets. Each classification has a different set of rules for calculating what you may deduct each year. Some call this Writing down allowance or amortization.

The CRA has a guide to help distinguish between an expense that can be written of in the year it was incurred and an expense that has a longer life and needs to be written off in portions, over its perceived life (Computer).

I would recommend you set a specific accounting policy for your business to distinguish between the two. Purchases valued at $500 or less = Expense. Purchases at $501 or more = Asset. Adjust this based upon your specific business. If you regularly spend in excess of 500 on items but your Assets are more in the $thousands then you could set your threshold at $2000, for example.

Capital Cost Allowance Classifications (Asset classes)

Don’t be alarmed at the table! Most of this won’t relate to you.

First you want to establish WHEN the item was purchased. For most of us our assets fall into class 10, 10.1 or 50 and some in Class 8.

| Class | Rate (%) | Description |

|---|---|---|

| 1 | 4 | Most buildings you bought after 1987 and the cost of certain additions or alterations made after 1987. The rate for eligible non residential buildings acquired after March 18, 2007, and used in Canada to manufacture and process goods for sale or lease includes an additional allowance of 6% (total 10%). For all other eligible non residential buildings in this class, the rate includes an additional allowance of 2%(total 6%). To be eligible for the additional allowances, elections have to be filed. For more information, go to Class 1 (4%). |

| 3 | 5 | Most buildings acquired before 1988 (or 1990, under certain conditions). Also include the cost of additions or alterations made after 1987. For more information, go to Class 3 (5%). |

| 6 | 10 | Frame, log, stucco on frame, galvanized iron, or corrugated metal buildings that meet certain conditions. Class 6 also includes certain fences and greenhouses. For more information, go to Class 6 (10%). |

| 8 | 20 | Property that you use in your business that is not included in another class. Also included is data network infrastructure equipment and systems software for that equipment acquired before March 23, 2004. For more information, go to Class 8 (20%) and Class 46 (30%). |

| 10 | 30 | General-purpose electronic data-processing equipment (commonly called computer hardware) and systems software for that equipment acquired before March 23, 2004, or after March 22, 2004, and before 2005 if you made an election. Motor vehicles and some passenger vehicles. For more information, go to Class 10 (30%) and Class 10.1 (30%). |

| 10.1 | 30 | A passenger vehicle not included in Class 10. For more information, go to Class 10.1 (30%). |

| 12 | 100 | The cost limit for access to Class 12 (100 %) treatment is $500 for tools acquired on or after May 2, 2006, and medical and dental instruments and kitchen utensils acquired on or after May 2, 2006. For more information, go to Class 12 (100%). |

| 13 | Varies | Leasehold interest – You can claim CCA on a leasehold interest, but the maximum rate depends on the type of leasehold interest and the terms of the lease. |

| 14 | Varies | Patents, franchises, concessions, or licences for a limited period. Your CCA is the lesser of the total of the capital cost of each property spread out over the life of the property, or the undepreciated capital cost to the taxpayer as of the end of the tax year of property of that class. |

| 14.1 | 5 | Starting January 1, 2017, include in Class 14.1Footnote1 property that:

Examples for farming are milk and eggs quotas. Examples for business, professional, and fishing are franchises, concessions, or licences for an unlimited period. For tax years that end prior to 2027, properties included in Class 14.1 that were acquired before January 1, 2017 will be depreciable at a CCA rate of 7% instead of 5%. Transitional rules will apply. Properties that are included in Class 14.1 and acquired after 2016 will be included in this class at a 100% inclusion rate with a 5% CCA rate on a declining‑balance basis and the existing CCA rules will normally apply. |

| 16 | 40 | Taxis, vehicles you use in a daily car-rental business, coin-operated video games or pinball machines acquired after February 15, 1984, and freight trucks acquired after December 6, 1991, that are rated higher than 11,788 kilograms. |

| 17 | 8 | Roads, parking lots, sidewalks, airplane runways, storage areas, or similar surface construction. |

| 29 | Varies | Eligible machinery and equipment used in Canada to manufacture and process goods for sale or lease, acquired after March 18, 2007 and before 2016, that would otherwise be included in Class 43. |

| 38 | 30 | Most power-operated, movable equipment you bought after 1987 that was use for excavating, moving, placing, or compacting earth, rock, concrete, or asphalt.Footnote2 |

| 43 | 30 | Eligible machinery and equipment, used in Canada to manufacture and process goods for sale or lease that are not included in Class 29. For more information, go to Class 43 (30%). |

| 43.1 | 30 | Electrical vehicle charging stations (EVCSs) set up to supply more than 10 kilowatts but less than 90 kilowatts of continuous power. For property acquired for use after March 21, 2016 that has not been used or acquired for use before March 22, 2016. |

| 43.2 | 50 | Electrical vehicle charging stations (EVCSs) set up to supply 90 kilowatts and more of continuous power. For property acquired for use after March 21, 2016 that has not been used or acquired for use before March 22, 2016. |

| 46 | 30 | Data network infrastructure equipment and systems software for that equipment acquired after March 22, 2004, (if acquired before March 23, 2004, include them in Class 8 (20%). For more information, go to Class 46 (30%). |

| 50 | 55 | General-purpose electronic data-processing equipment (commonly called computer hardware) and systems software for that equipment, including ancillary data-processing equipment acquired after March 18, 2007, and not included in Class 29. For more information, go to Class 50 (55%). |

| 53 | 50 | Machinery and equipment acquired after 2015 and before 2026 that is used in Canada mainly to manufacture and process goods for sale or lease. |

Maintaining a Fixed Asset Register to make sense of Capital Allowances.

This may seem more than a little intimidating but if you download the spreadsheet and follow along I’m 99% certain you will be OK with your CCA claims!

A register is simply that – a list of what you purchased, classed as an asset and not an expense and how much you wrote off in each year.

Here’s the template for you to use. Fixed Asset Register

Simply keep all of your receipts and follow the above table to determine their classification. The percentage rate in the second column is how much you can write off in one year.

When in doubt, always call the CRA and check any of the above information as tax classes can change year on year.

Start up costs – I purchased some things before I really Got Going.

What is a Start-Up Cost?

A start-up cost is any money you need to spend to get your business off the ground. This can include your car, office equipment, inventory or anything else you need to begin operating in your chosen field. To be eligible these things need to be purchased in your first fiscal year.

Need to use your personal vehicle for business? You can transfer ownership of the vehicle from yourself to your company. There are a variety of reasons you may need to transfer personal property to your small business. The Canada Revenue Agency (CRA) has a specific process on how to account for these transactions, and the steps vary based on your business structure. Ensure that you handle these transactions correctly to avoid future headaches.

Transfer Personal Assets to Sole Proprietorship

If you’re a sole proprietor, you must transfer assets using fair market value. Imagine that you bought a computer for $1,000. You use the computer personally for a couple of years and its value declines. To determine its fair market value currently, you look at the prices of similar used computers for sale and assess that the computer is worth $500. When you transfer the computer to your business, you treat the transaction as if your business purchases the computer from you for $500. This is the number you use when establishing your capital cost allowance for your tax return.

Claimable Start-Up Costs

Your business start up costs can include any reasonable expenses for anything your business needs to get started. Personal expenses are not deductible. You are only able to deduct legitimate business expenses.

Legitimate expenses can include:

- Advertising

- Business tax, fees, licenses, and dues

- Business-use-of-home expenses

- Insurance

- Motor vehicle expenses

- Legal, accounting, and professional fees

- Office expenses

- Supplies

- Telephone and utility bills

Rules for GST/HST / VAT

This is a whole other area of applicable taxes that bloggers need to be aware of. The Income threshold in Canada for registration is $30,000. There is more on this particular tax and it’s rules in [Taxes. Everything you need to know to file this tax season].

Additional excellent reading can be found here:- Bookkeeping Essentials.Com

The rules about digital e-products sold out of country, out of province, etc are all different so read the article carefully!

What constitutes “INCOME”

This is easy and also, not so straightforward as you might think! In a nutshell, if you made even so much as a penny, you made an income. If you received Freebies (as incentive or to review) you need to know the fair market value of these items and declare that as Income. If you received Gift cards, work in return for work (bartering) or any other advantage that you may have otherwise had to pay for…this is income. Benefits-in-kind can range from free subscriptions or media trips to a demo Kitchen Aid Mixer.

If in doubt – declare it.

There is a unique rule that happens in the US when affiliate have their commissions paid into their Paypal account. Both the affiliate sponsor and Paypal issue a 1099-Misc or 1099-K to inform the IRS if you made more than the reporting threshold ($600 for one and $20,000 for the other, I believe). When this happens you may be asked to explain why your declared income is less than the IRS has been notified of by these two reporting entities. In this case there is paperwork sent to you to allow you to explain so – Do just that. Explain!

Need specific answers to specific questions – put them in the comments and I will do the best I can for you.

XO

Anna

This is wonderful advice. I clicked on this right away because I have been meaning to start looking into this. I haven’t made anything so far with blogging other than some affiliates & some product exchange but it’s my goal within this next year to really start monetizing. I will be pinning this for sure! Thanks for sharing!

-Madi xo | http://www.everydaywithmadirae.com

My pleasure!

Don’t forget to come back and comment with any questions that may arise. I’d love to help!

XO

Anna