Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase .

Paying for school.

Is that your responsibility or your kids?

I always said I wanted more for my kids than I got myself. Coming from a single parent, welfare family, going to University was never on the cards for me. That being said, I did go to college and then onto Accountancy School. All together I was in school for 7 years post High School and I worked full time for five of those years.

The first part of my schooling I paid for myself and the second was paid for by my employers. I believe these workplace opportunities still exist but they tend to be geared more towards the trades than academics.

So – how do you put your kids through school without going into debt?

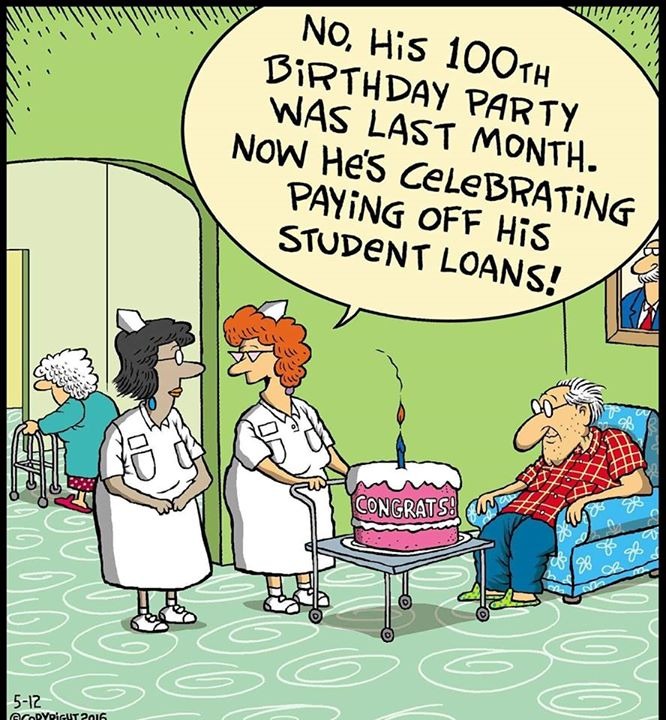

Student Loan debt

Millennial’s face 1 trillion dollars in debt as student loans pile up (Bloomberg). If you’re a student in this situation, facing a lifetime of debt to earn a degree that no longer guarantees you a top paying job, then my heart goes out to you.

This is something I wanted to avoid for my kid. Darling Daughter leaves for Calgary in 6 weeks to start her Design course. We were fortunate enough to start RESP’s for our kids in 2009 which will pay for the college courses but what about accommodation, food, living La Vida Loca?

Accommodation costs for the first year fall at just shy of $7000. We have allocated a $100 per week for approximately 35 weeks allowance for groceries, etc but after that…she’s on her own. Fashion shows, Gallery openings, being a “lovey” – that’s on her. Fortunately I raised a money savvy maven and she has worked since she was 14 (don’t judge – she bused tables in the restaurant where her Daddy was the Head chef) and she’s currently looking for Summer work before she leaves.

So far our spend comes in at $10,500 for the year. You may think that’s not a great deal of money to put a kid through school for one year but imagine if the course fee’s weren’t covered already? Her course is only (!??!) $10 grand but others can be in excess of $100,000. How does anyone manage that?

Through hard work and diligent budgeting we paid the accommodation costs and transferred $3000 to her chequing account. I’m a HUGE advocate of budgets. Take a spin through “Master Your Money”. I wrote this post when the Superbundle was brand new and now, a few months later, it’s still worth every penny (Less than $50) I spent on it.

If you have a college aged student then there is also the worry of what are they going to eat? How will they manage? Here is a great site showing microwave Dorm Friendly meals.

Whilst my kid is fiscally responsible she is not budget savvy. If her recent trip to Europe (self funded) is anything to go by then she is going to need help with budgeting, meal planning and grocery shopping (which she has NEVER undertaken for herself).

To put my mind at ease I created a student planner (printables) “The College Survival Manual” in Blue and Pink. I have reduced the prices in this post to just $1.00 until July 31st (when they will go back to $9.99) so get em whilst the getting’s good. Let your friends know.

It’s time to let go Momma. They’re ready but your not?

Have a little peace of mind, knowing you have set them up for success and leave them with a reminder of how much you care.

19 pages of everything “they” don’t think about but – you did!

Budgets, Expense trackers, Meal planners and grocery lists, Emergency contact info, Special recipes they can make themselves (without burning down the dorm or getting food poisoning). “How To” sheets that are self customizable – does your kid know how to function in a coin op laundry? What about receiving Emergency Funds through a third party (like Western Union)?

Print as many times as you need to produce a custom binder that will put your mind at rest knowing that, should they need you, and you’re not there, this binder will have everything they need to figure it out by themselves.

How to pay for Year Two..

We have exactly twelve months to find another $10,000 (Accommodations and budgeted weekly allowance). This is where my awesome budgeting skills come in.

Collectively we bring in $4,500 a month. Our outgoing bills, Mortgage, hydro, car etc plus our weekly food budget ($200 for four people) leave is with between $1000 and $1500 per month to invest, save, spend. If I throw the entire amount at School it takes me ten months to accomplish the mission but, there’s no frills, no trips, no treats and honestly, I think that’s a wee bit too hard so…

I have twelve months to find $7000 (Accommodation only) and then I could (technically) transfer $100 per week directly on budget day. This should scare the pants off her and also help her to understand that there needs to be more money at the end of the month than month at the end of the money. It also means that my monthly transfer would be $400 to $500 for seven more months and not $1000 – $1500 for three months. This allows breathing space for the family to actually enjoy life a little.

Whilst I like this plan waaay more it will require discipline and a strict adherence to the budget. Food for thought.

A Conscious decision.

We made the decision to pay for school for our kids and that is a personal choice. I paid for myself (mostly) and some parents out there just cannot afford to do this.

If you’re just starting out with kids then an RESP is a lifeline that will enable them to make their own choices about school.

Kid #2 will have exactly the same as Kid #1 but, he is Special needs and wants to do a Doctorate in Chemistry. My throat goes dry when I look into the costs for that bad boy! That is a struggle for another day and, there’s always Finland… where school is free.

I hope you find the tools in this post useful and if you have any advice for other parents sending their kids off to college this fall – add them to the comments. Every little helps.

XO

Anna

Child’s education is very expensive. I feel like I can’t afford to have more kids.